Best Reasons Why Retirement Service is Important will be described in this article.

Best 12 Reasons Why Retirement Service is Important

In this article, you can know about Best 12 Reasons Why Retirement Service is Important here are the details below;

There are several ways to safeguard our future, which is very vital at every step. We all listen to our parents discuss the necessity of saving money or the value of investing in the correct things. We don’t come to grasp these things when we are young; rather, we come to understand them as adults when we have obligations, a family to care for, and children to raise.

The investment plans that allow you to save money till retirement are one of the many strategies to secure your future. You start making regular contributions of a particular amount as soon as you decide to invest in a retirement plan. You begin receiving a defined sum from your retirement plan at regular periods once you reach the retirement stage and your workplace income quits.

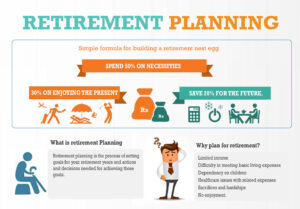

Overview of retirement planning

There are several advantages to retirement plans, and they can help you stay safe without worrying about your income. You can cover your everyday and essential costs with the money you get from your retirement plan. You can pick from a variety of plans based on your needs.

12 Arguments in Favor of Retirement Planning

You already know how vital it is to invest in a retirement plan. But first, let’s explore why it’s significant before going farther to assist you in comprehending and securing your future.

The following are the main arguments in favour of retirement planning:

- Keep Stress at bay: Many health issues are brought on by a lack of money and the inability to meet necessities. Anxiety, depression, and a general sense of unhappiness are caused by money issues! Maintaining your entire financial wellbeing will ensure the security of your present and future.

- Leave a legacy: Planning ahead for your retirement and transferring your life savings to your loved ones so they can live comfortably when you pass away.

- Maintain your lifestyle: If you’ve been living large your entire life, you can do so with your retirement income. You won’t have to give up your way of life.

- Independently Living: Having a wise retirement plan can help you maintain your independence and stop you from depending on your kids for financial support.

- Medical Expenses: As you age, your body will demand more attention in terms of medical needs. Your retirement savings can cover future hospital or medical expenses for you.

- Relief from Tax: Everyone who earns money wants to minimise their tax obligations and increase their savings. Various financial instruments that you can incorporate in your retirement plan are excluded from tax benefits under our government. It is a practical approach to save money while simultaneously planning and securing your future.

- Tick off that bucket list: Using your retirement plan assets to pursue a new interest or a long-forgotten passion can help you cross something off your bucket list. Maybe you’ve always wanted to launch a side project, a fresh office endeavour, or a brand-new skill. With your wise retirement funds, you can cover anything.

- Living at ease even with inflation: Inflation keeps going up every other day and can be a problem in the future if you don’t have a job or money. However, if you have a retirement plan and have guaranteed your future, even inflation won’t affect you. You may carry on peacefully.

- Retire Early: If you began saving for your retirement at a young age, you may be able to retire early. There is no set age at which you must retire. You can feel confident understanding that you are protected by your plan for a very long time.

- You won’t have to sell off your assets/property: If you make sound preparations for your future or old age, you won’t have to face a circumstance where you must sell your priceless property or assets in order to survive.

- Choose plans as per your lifestyle: if that fits your lifestyle; for example, if you lead a very basic life, you can arrange your retirement funds accordingly. If you are single, divorced, or widowed, your costs will be significantly lower. You can budget your savings to ensure that you have enough for yourself.

- Save that extra money: Spend less money on your retirement plan if you start saving sooner in retirement rather than waiting until you are retired. Start early, invest modestly, acquire more, and enjoy a carefree future.

When Should You Begin Planning for Your Retirement?

It’s crucial to look for a secure retirement plan if you want to maintain your financial stability. Understanding your life goals will be possible thanks to a methodical retirement strategy. Why should you begin planning ahead of time?

Your income or financial situation may change during your life. Starting your planning early in life is always a good idea. You have plenty of time to invest over a long period of time, easing the load in the long run. Also check online tutoring services

Typically, you should begin planning for retirement when you are 30 years old and can afford to invest or save a reasonable amount each month.

FAQs about Retirement Planning

You could still have some questions that need to be answered, so we’ve compiled a list of some crucial inquiries that you might have. We’re here to assist you.

What is the best retirement strategy for someone who works for themselves? Although you cannot rely on the PPF or LTA since you are self-employed, it is still possible to create a retirement plan. You can determine your family’s demands, your income flow, and your saving pattern to begin with. Search for several investing strategies that provide excellent benefits and returns, then get preparing.

Here are several methods to invest:

Securities Gold Mutual funds

bonds for infrastructure

Q2. What Would Happen If Someone Passed Away Before Drawing Retirement Benefits?

– If you are a nominee, you must fill out a Composite Claim Form In Death Cases at the regional office or online in order to receive retirement benefits. The nominee must possess an Aadhaar card that corresponds to the records that the dead person supplied.

If the deceased was deceased during his service, the candidate will thereafter be eligible for the pension/retirement income on a monthly basis. The nominee will be qualified for the pension as a lump payment during withdrawal if the deceased passed away well after his service years.

Q3. Should I opt for monthly payments of retirement funds or a lump sum?

– Large financial resources may allow you the freedom to be flexible with your spending or investing decisions. However, it might encourage you to spend more money without concern for the future, which could be detrimental.

Regular retirement funds arrive each month with a set amount that can help you budget your monthly expenses and stay within that range.

According to a Consumer Finance Protection Bureau analysis from 2020, pensioners with pension income had a much higher likelihood of maintaining their financial stability than those who had taken a lump sum. After five years, 73% of those who received regular payments could continue to spend at the same levels, as opposed to only 56% of those who opted for the lump amount.

How Do I Set My Long-Term Financial Goals?

This should be a continuous process where you keep setting short-term and long-term financial objectives based on your existing lifestyle and expenses. Create monthly budgets based on your costs, and then look for opportunities to save more each month. This will enable you to compare your reasonable and true spending. The best course of action is usually to make long-term plans. You could imagine yourself with money set aside for the future if you start taking good care of and managing your costs.

Which should I save for first: retirement or other significant life expenses?

– Just as important as preparing for retirement is saving for your major life costs. If you plan well, you can accomplish both. You can allocate a set percentage to retirement savings and the remaining percentage to other significant costs. Making intelligent and prudent decisions is the best course of action.

Conclusion

We hope you now have a basic knowledge of the significance of retirement planning and the numerous ways it may benefit you, your family, and your future. As you become older, you’ll realise how important it is to spend your savings on the proper things. Starting early gives you more time to save and even gives you the option of retiring early.

Get Professional Advice To Select A Retirement Plan

With all these advantages, it is clear that this is a significant investment break that you shouldn’t pass up.

Starting now! Many people have received our assistance in securing their future. Let’s protect yours as well. Give us control of your destiny so we can assist you in making plans for tomorrow starting today.

Get Professional Advice To Select A Retirement Plan

There are several ways to safeguard our future, which is very vital at every step. We all listen to our parents discuss the necessity of saving money or the value of investing in the correct things. We don’t come to grasp these things when we are young; rather, we come to understand them as adults when we have obligations, a family to care for, and children to raise.

The investment plans that allow you to save money till retirement are one of the many strategies to secure your future. You start making regular contributions of a particular amount as soon as you decide to invest in a retirement plan. You begin receiving a defined sum from your retirement plan at regular periods once you reach the retirement stage and your workplace income quits. Also check legal services

Overview of retirement planning

There are several advantages to retirement plans, and they can help you stay safe without worrying about your income. You can cover your everyday and essential costs with the money you get from your retirement plan. You can pick from a variety of plans based on your needs.

12 Arguments in Favor of Retirement Planning

You already know how vital it is to invest in a retirement plan. But first, let’s explore why it’s significant before going farther to assist you in comprehending and securing your future.

The following are the main arguments in favour of retirement planning:

- Keep Stress at bay: Many health issues are brought on by a lack of money and the inability to meet necessities. Anxiety, depression, and a general sense of unhappiness are caused by money issues! Maintaining your entire financial wellbeing will ensure the security of your present and future.

- Leave a legacy: Planning ahead for your retirement and transferring your life savings to your loved ones so they can live comfortably when you pass away.

- Maintain your lifestyle: If you’ve been living large your entire life, you can do so with your retirement income. You won’t have to give up your way of life.

- Independently Living: Having a wise retirement plan can help you maintain your independence and stop you from depending on your kids for financial support.

- Medical Expenses: As you age, your body will demand more attention in terms of medical needs. Your retirement savings can cover future hospital or medical expenses for you.

- Relief from Tax: Everyone who earns money wants to minimise their tax obligations and increase their savings. Various financial instruments that you can incorporate in your retirement plan are excluded from tax benefits under our government. It is a practical approach to save money while simultaneously planning and securing your future.

- Tick off that bucket list: Using your retirement plan assets to pursue a new interest or a long-forgotten passion can help you cross something off your bucket list. Maybe you’ve always wanted to launch a side project, a fresh office endeavour, or a brand-new skill. With your wise retirement funds, you can cover anything.

- Living at ease even with inflation: Inflation keeps going up every other day and can be a problem in the future if you don’t have a job or money. However, if you have a retirement plan and have guaranteed your future, even inflation won’t affect you. You may carry on peacefully.

- Retire Early: If you began saving for your retirement at a young age, you may be able to retire early. There is no set age at which you must retire. You can feel confident understanding that you are protected by your plan for a very long time.

- You won’t have to sell off your assets/property: If you make sound preparations for your future or old age, you won’t have to face a circumstance where you must sell your priceless property or assets in order to survive.

- Choose plans as per your lifestyle: if that fits your lifestyle; for example, if you lead a very basic life, you can arrange your retirement funds accordingly. If you are single, divorced, or widowed, your costs will be significantly lower. You can budget your savings to ensure that you have enough for yourself.

- Save that extra money: Spend less money on your retirement plan if you start saving sooner in retirement rather than waiting until you are retired. Start early, invest modestly, acquire more, and enjoy a carefree future.

When Should You Begin Planning for Your Retirement?

It’s crucial to look for a secure retirement plan if you want to maintain your financial stability. Understanding your life goals will be possible thanks to a methodical retirement strategy. Why should you begin planning ahead of time?

Your income or financial situation may change during your life. Starting your planning early in life is always a good idea. You have plenty of time to invest over a long period of time, easing the load in the long run.

Typically, you should begin planning for retirement when you are 30 years old and can afford to invest or save a reasonable amount each month.

FAQs about Retirement Planning

You could still have some questions that need to be answered, so we’ve compiled a list of some crucial inquiries that you might have. We’re here to assist you.

What is the best retirement strategy for someone who works for themselves? Although you cannot rely on the PPF or LTA since you are self-employed, it is still possible to create a retirement plan. You can determine your family’s demands, your income flow, and your saving pattern to begin with. Search for several investing strategies that provide excellent benefits and returns, then get preparing.

Here are several methods to invest:

Securities Gold Mutual funds

bonds for infrastructure

Q2. What Would Happen If Someone Passed Away Before Drawing Retirement Benefits?

– If you are a nominee, you must fill out a Composite Claim Form In Death Cases at the regional office or online in order to receive retirement benefits. The nominee must possess an Aadhaar card that corresponds to the records that the dead person supplied.

If the deceased was deceased during his service, the candidate will thereafter be eligible for the pension/retirement income on a monthly basis. The nominee will be qualified for the pension as a lump payment during withdrawal if the deceased passed away well after his service years.

Q3. Should I opt for monthly payments of retirement funds or a lump sum?

– Large financial resources may allow you the freedom to be flexible with your spending or investing decisions. However, it might encourage you to spend more money without concern for the future, which could be detrimental.

Regular retirement funds arrive each month with a set amount that can help you budget your monthly expenses and stay within that range.

According to a Consumer Finance Protection Bureau analysis from 2020, pensioners with pension income had a much higher likelihood of maintaining their financial stability than those who had taken a lump sum. After five years, 73% of those who received regular payments could continue to spend at the same levels, as opposed to only 56% of those who opted for the lump amount.

How Do I Set My Long-Term Financial Goals?

This should be a continuous process where you keep setting short-term and long-term financial objectives based on your existing lifestyle and expenses. Create monthly budgets based on your costs, and then look for opportunities to save more each month. This will enable you to compare your reasonable and true spending. The best course of action is usually to make long-term plans. You could imagine yourself with money set aside for the future if you start taking good care of and managing your costs.

Which should I save for first: retirement or other significant life expenses?

– Just as important as preparing for retirement is saving for your major life costs. If you plan well, you can accomplish both. You can allocate a set percentage to retirement savings and the remaining percentage to other significant costs. Making intelligent and prudent decisions is the best course of action.

Conclusion

We hope you now have a basic knowledge of the significance of retirement planning and the numerous ways it may benefit you, your family, and your future. As you become older, you’ll realise how important it is to spend your savings on the proper things. Starting early gives you more time to save and even gives you the option of retiring early.

Get Professional Advice To Select A Retirement Plan

With all these advantages, it is clear that this is a significant investment break that you shouldn’t pass up. Also check business card printing services

Starting now! Many people have received our assistance in securing their future. Let’s protect yours as well. Give us control of your destiny so we can assist you in making plans for tomorrow starting today.